With an Equifaxbusiness credit report, you can also see:Ĭhecking business credit scores is a smart way to protect your business. Low scores indicate higher risk.Įquifax uses data collected by the Small Business Finance Exchange (SBFE) in its reporting along with trade credit information and public record data. Business Failure Score: The business failure score goes from 1,000 to 1,610 and assesses the risk of companies going out of business within the upcoming year.A score of 0 designates bankruptcy, while a score in the 90s indicates the company generally pays its bills on time. Payment Index: The payment index score ranges from 0 to 100 and measures your payment history and whether bills are paid on time.A score of 556 is generally considered good credit. Business Credit Risk: The business credit risk score ranges from 101 to 992.

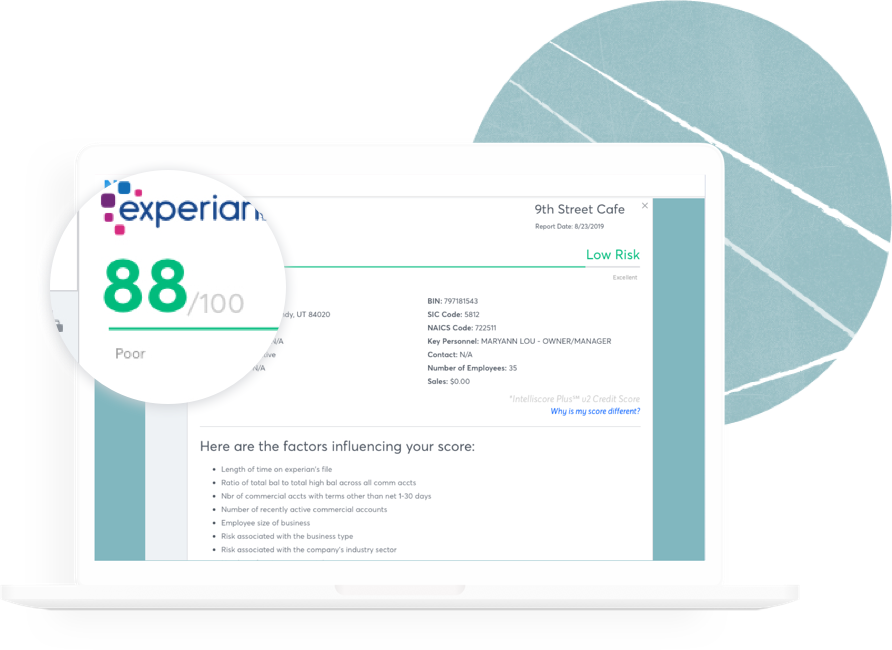

In addition to the business credit score, you can also get:Įquifax approaches the process slightly differently by producing three different types of credit scores to help assess risk. Experian also assigns one of five risk classes to help businesses assess creditworthiness.Įxperian gathers data from lenders and suppliers, credit card companies, collection agencies, banks, and public filings. IntelliScore from Experian also uses a scale of 1-100, with 100 being the highest. If vendors do not contribute their information to D&B, it can impact your business credit score.Īlong with a business credit score, a business credit report from D&B can also include: A 70 would indicate 15 days late on payments.Ī D&B business credit score of 40 or less indicates you have bills that are 60 days or more past due.ĭ&B relies on information from suppliers reporting credit usage to the company. To earn a 100, you would need to pay your bills 30 days sooner than terms.Ī score of 50 shows that you are 30 days late on some bills. Scores in the 80-100 range are considered good.Ĩ0 indicates you make your payments on time. The higher your number, the better your credit score. The Dun & Bradstreet PAYDEX business credit score ranges from 0-100. To help you better understand the differences, we will explain how Dun & Bradstreet, Experian, and Equifax assess business credit and how they define a good score. The three largest business credit reporting agencies have unique scoring methods and ways to evaluate a good business credit score. So, what is a good business credit score? It depends on which credit bureau you use. Unlike a consumer credit score, which uses a fairly standard ranking system, business credit reporting bureaus use different data sets. You can use our on-demand self-serve options or our credit management tools to monitor multiple accounts or your entire credit portfolio. When you are trying to decide whether to extend credit to a customer or send a purchase order to a supplier, checking if they have a good business credit score gives you the confidence that you will be paid on time or receive the supplies you order.Īt Command Credit, we make it easy to check your business credit score or those of your customers and suppliers. It can help if you need to take out a business loan or establish credit with another company. A good business credit score can help you get financing more easily.

0 kommentar(er)

0 kommentar(er)